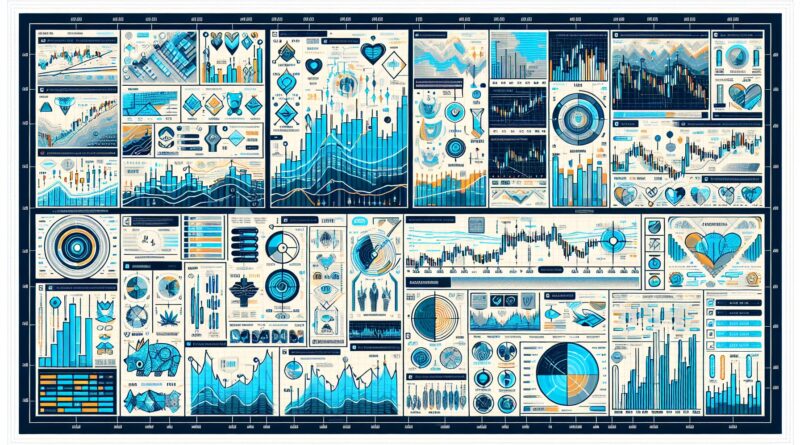

Technical Analysis: Key Patterns and Indicators Every Day Trader Should Know

As an active trader, having an in-depth understanding of technical analysis is indispensable in making informed trade decisions. Technical analysis involves the study of statistical trends gathered from trading activities such as price movement and volume. The primary tool used in technical analysis is charting patterns, which help traders predict future price movements, and the cornerstone of charting is the use of technical indicators. This article will delve into key patterns and indicators necessary for efficient day trading.

Understanding Chart Patterns

Chart patterns are the basics of technical analysis. They reflect the battle between buyers and sellers, dictating whether a currency, commodity, or stock is likely to move up or down. Here are some key patterns every trader should know:

-

Head and Shoulders: A head and shoulders pattern is formed when a stock’s price rises to a peak and subsequently declines, then the price rises above the previous peak and again declines, and finally, the price rises but not to the second peak and declines again. The first and third peaks are shoulders, and the second peak forms the head.

-

Double Top and Double Bottom: The double top is a reversal pattern observed in an uptrending market, suggesting a market’s resistance level, whereas a double bottom implies the level of support in a downtrend and signifies a potential reversal of a declining trend.

-

Cup and Handle: This pattern occurs when the price rises, falls, and rises again to the original level, forming a cup, followed by a smaller decline and rise, forming the handle. This signals a bullish trend.

-

Bull Flag and Bear Flag: These indicate continuation patterns where the market consolidated before continuing its current trend. Bull flags are preceded by an uptrend, while bear flags by a downtrend.

With a good comprehension of these chart patterns, traders can make informed decisions by recognizing the stages in a price cycle.

Vital Technical Indicators

Technical indicators, often plotted in a chart separate from the price, provide different ways to interpret stock movements apart from the simple price patterns. Here are some major technical indicators to consider:

-

Moving Averages (MA): This represents an average of a specific number of data points. It eliminates ‘noise’ in price data and presents a smoother representation of trends.

-

Relative Strength Index (RSI): RSI compares the size of recent gains to recent losses to identify overbought or oversold conditions of an instrument.

-

MACD – Moving Average Convergence Divergence: This is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

-

Bollinger Bands: These bands provide relative boundaries of highs and lows on two standard deviations away from a simple moving average. When price moves closer to either band, this could signify an overbought or oversold scenario.

-

Fibonacci Retracements: These use horizontal lines to identify potential levels of support or resistance.

-

Stochastic Oscillator: This measures the speed and change of price movements to predict price reversals.

Conclusion

With day trading, comprehending the labyrinth of technical analysis is not optional but a necessity. Recognizing patterns and understanding how to utilize technical indicators significantly increases your chances for a successful trade. It’s not about predicting future movements with certainty, but rather about making statistically informed decisions to mitigate risk and capitalize on opportunities. With a robust understanding of these tools, you can approach each trading day with greater confidence and precision.

Each pattern or indicator offers a glimpse into the financial markets’ behavior, offering traders a strategic advantage. The key is to find a combination of indicators and patterns that works best for you and your trading style. Remember, the more you understand technical analysis, the stronger your foundation for robust trading strategies becomes.

Keep in mind that while these tools can significantly improve your trading strategy, they do not guarantee success. They should be used in conjunction with other tools, a well-thought-out trading plan, and proper risk management strategies.